Credit represents your ability to borrow money or access goods and services with the understanding that you’ll pay back the lender at a later date. It’s essentially your financial trustworthiness.

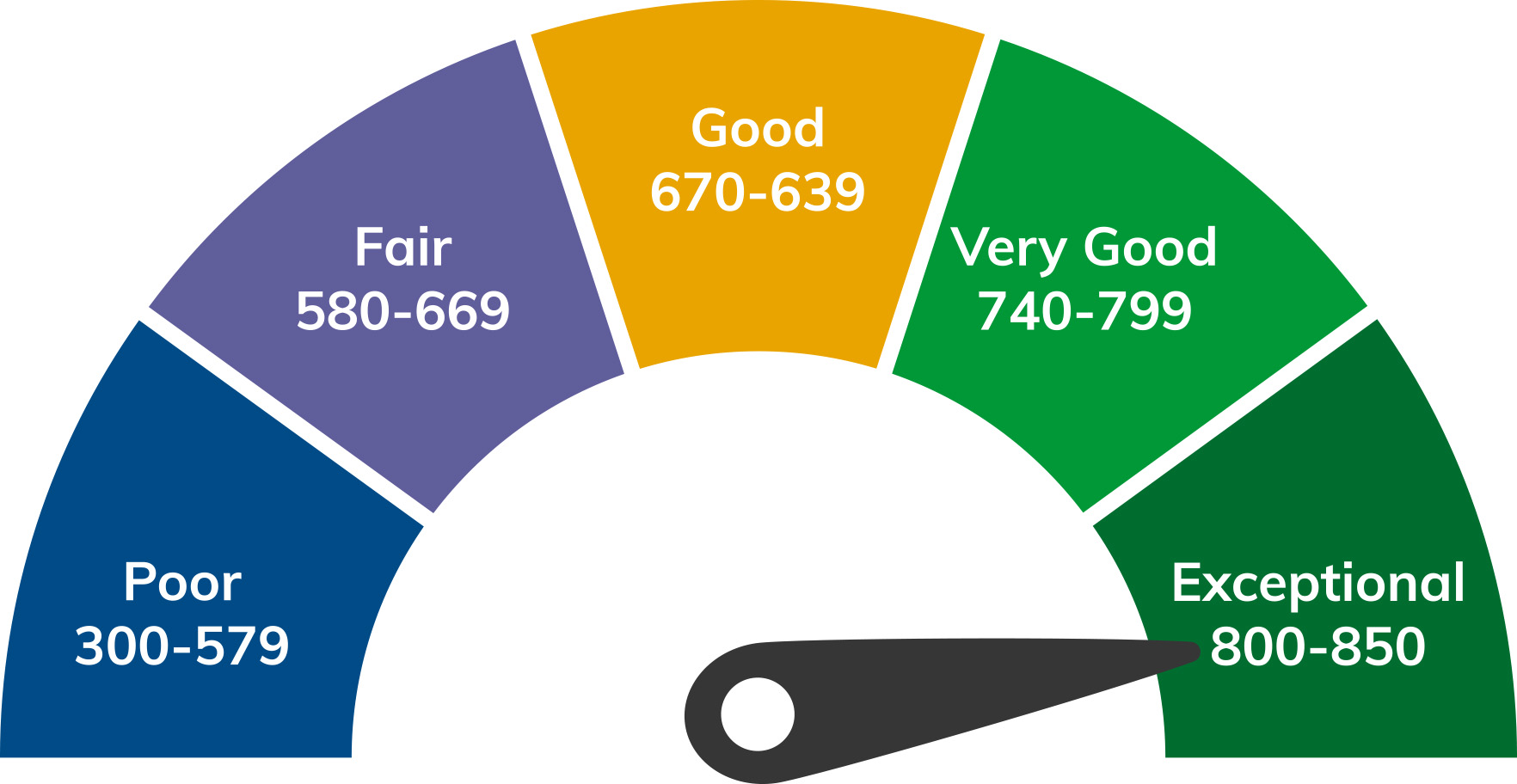

Your credit score impacts your ability to secure loans, the interest rates you receive, and can even influence job opportunities and housing options. A higher credit score can lead to lower interest rates, which will save you money over time.

Several factors can influence your credit score, including:

Timely payments positively affect your score, while late payments can cause it to drop.

The ratio of your current revolving credit (like credit card balances) to the total available credit. Lower utilization rates are better for your score.

Longer credit histories tend to have a positive impact, as they provide more data on your borrowing behavior.

A mix of credit types (e.g., credit cards, mortgage, auto loans) can positively afffect your score.

Opening several new credit accounts in a short period can negatively impact your score.

Your credit score is derived from your credit report, which is a detailed record of your credit history maintained by credit bureaus. The primary bureaus are TransUnion, Experian, and Equifax. Each report includes:

Here’s how you can build your credit score

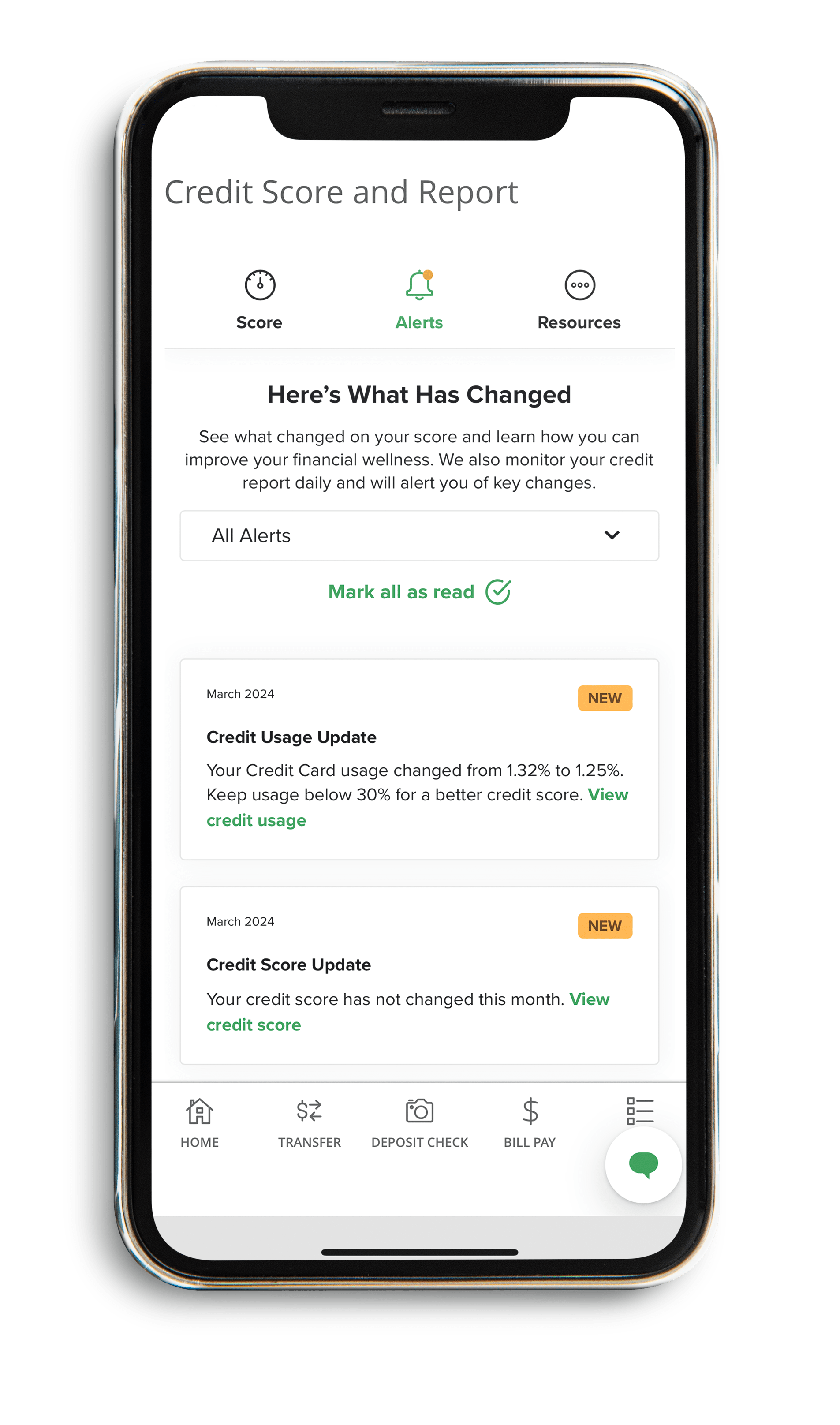

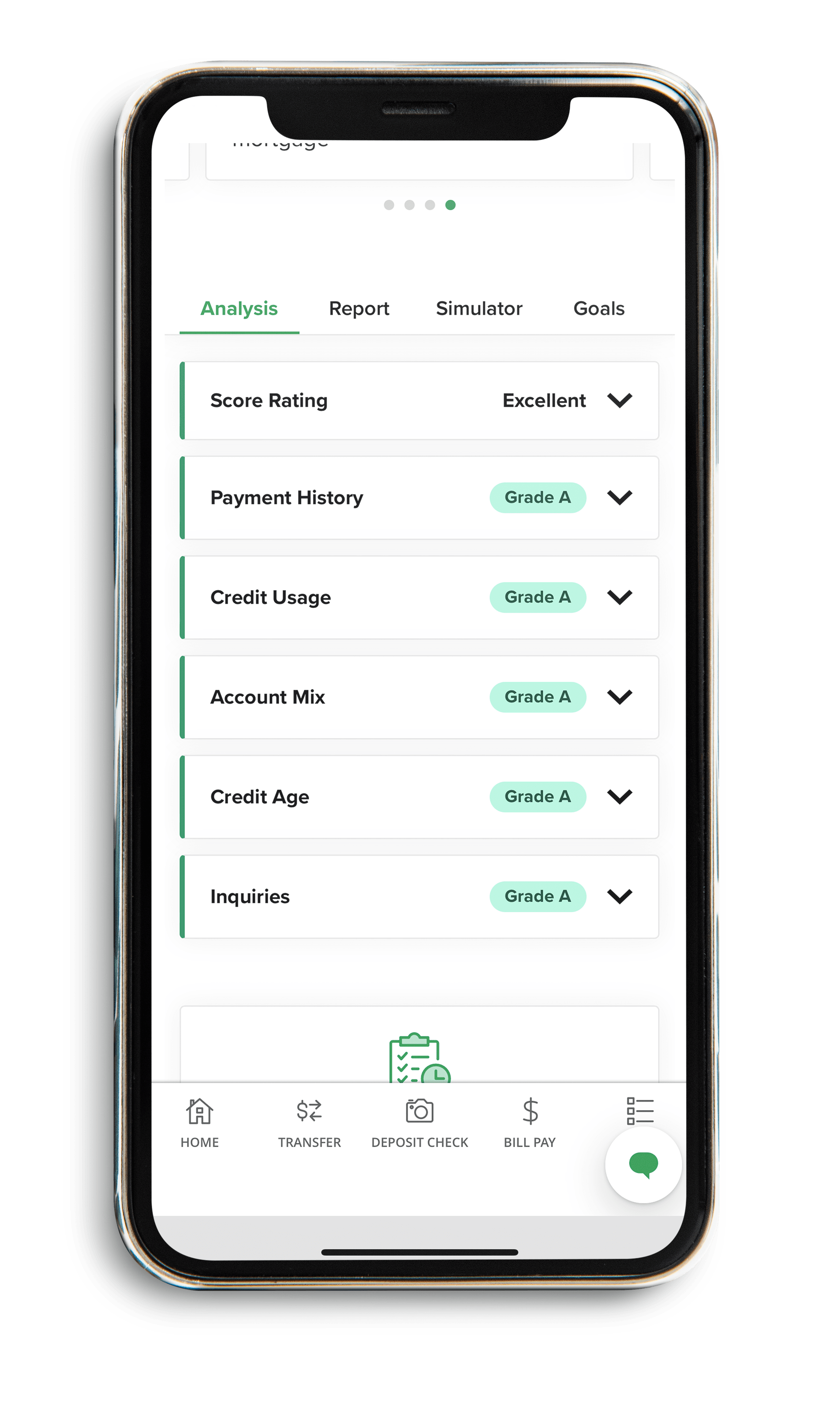

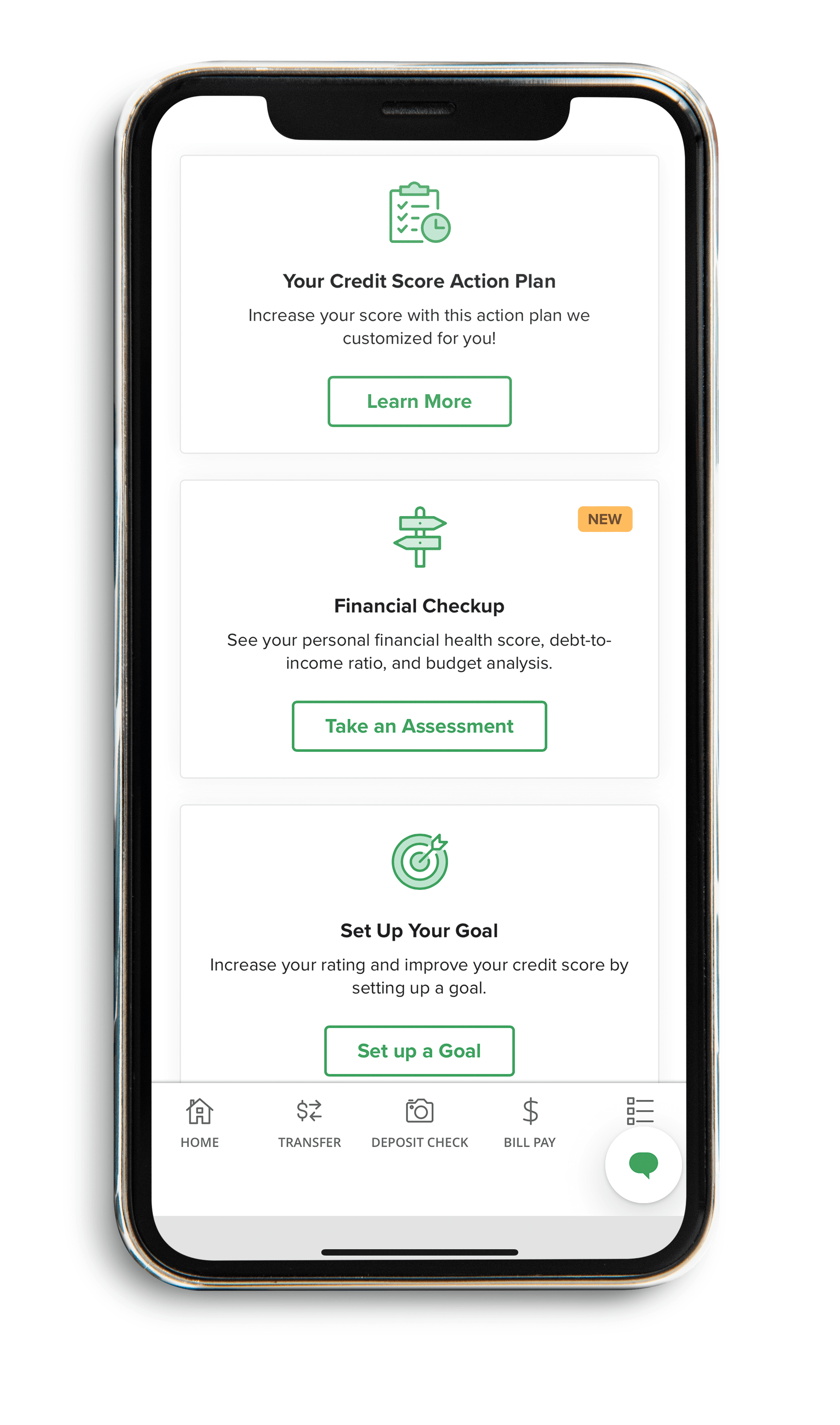

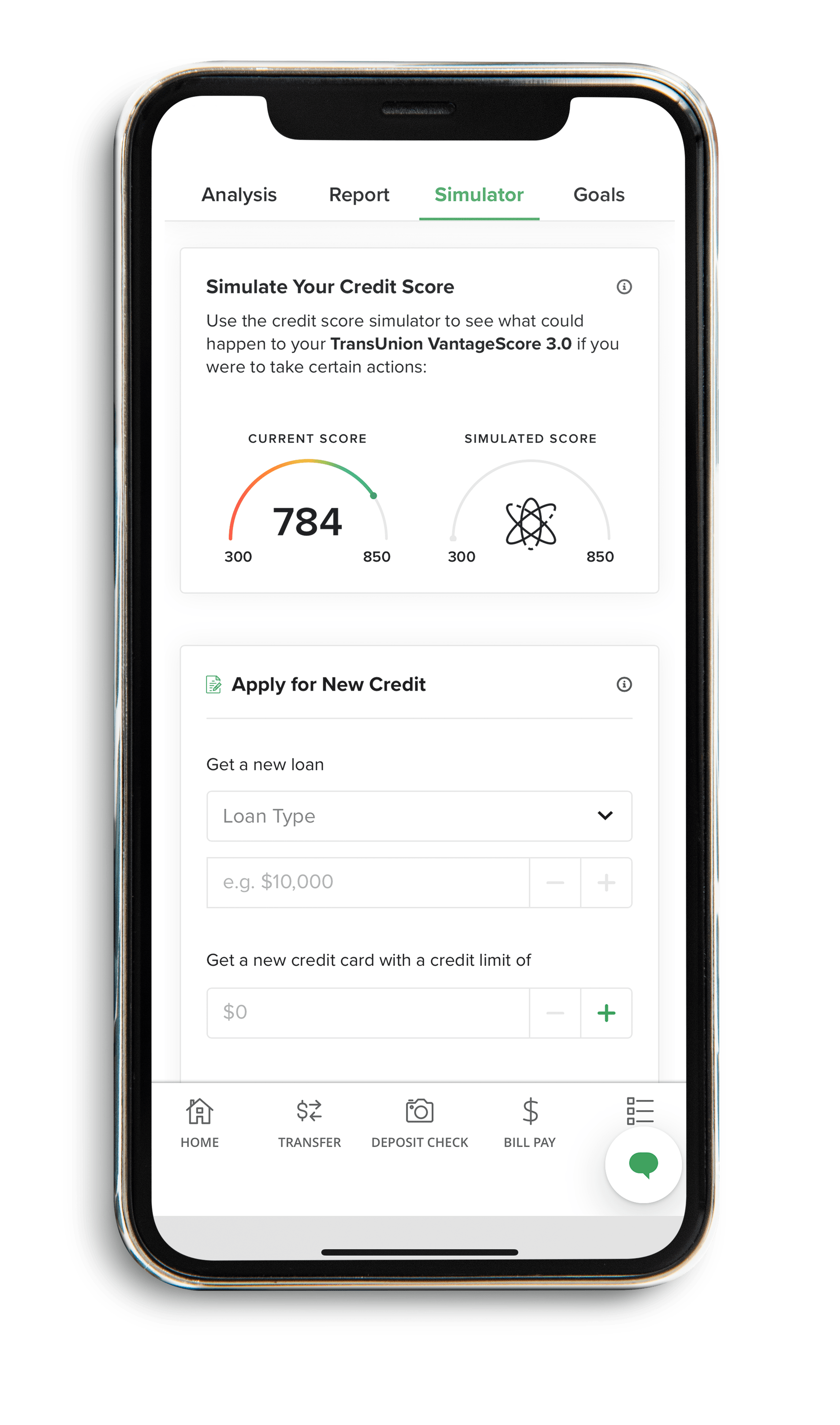

This useful tool is available in our Online and Mobile Banking platform and is designed to demystify credit scores for you.

Credit Expert offers:

Check your credit score anytime without negatively affecting it.

Understand the factors that influence your score and receive personalized tips for improvement.

Find financial tips and education to help you improve your credit score.

See how different financial decisions, like adding a loan or paying off a credit card balance, could impact your credit score.